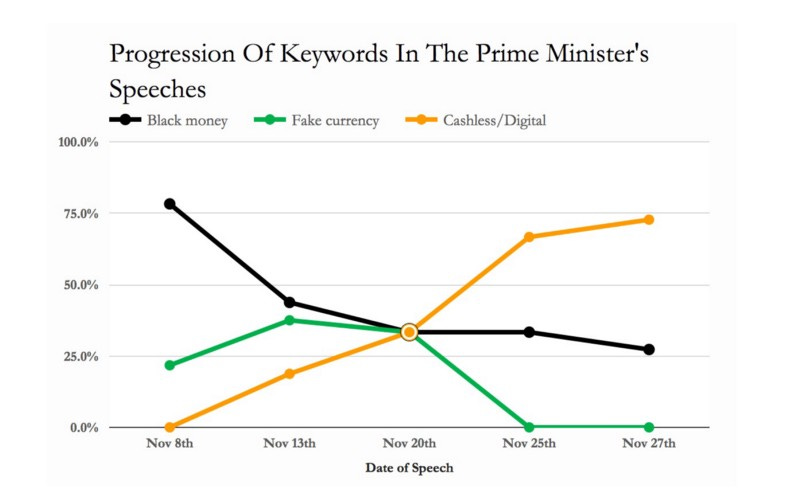

You can argue with opinions, but it’s hard to argue with data. Indiaspend has an interesting article on the keywords used in Modi’s post-demonetization speeches. Here’s a graphical summary in figure one:

Figure 1: From Indiaspend: “How Modi Changed (And Changed) The Demonetisation Narrative”

As you can see cashless replaced black money as the dominant keyword around November 20th and is now mentioned almost three times as often.

Of course, data is one thing and interpretation another: that graph lends itself to every possible interpretation. It took me about five seconds to come up with four interpretations:

Is cashless economy the new mantra because demonetization has no chance of ending corruption, that black money will find new avenues?

Is cashless economy the new mantra because black money was always a smokescreen; the underlying goal being the end of small business and the triumph of big money?

Is cashless economy the new mantra because the government is going after all the bribe takers and doesn’t want public unrest to derail their anti-corruption drive?

Is cashless economy the new mantra because netas and babus are the most affected by the new regime and they’re applying pressure on the government to roll back the radical shift?

Whether cashlessness was always the goal of demonetization or a response to changing conditions, it’s clear that a world without cash is considered a good thing by the Indian government.

Why’s that? I mean, it’s not as if the BJP’s core base is a fan of cashless payments: the whole premise behind electronic payments is that cash can be hidden under a mattress while electronic bits are traceable. Unless you use a cryptocurrency. We might well see a huge upsurge in cryptocurrency use in India.

That’s what I want to understand: setting aside the secrecy behind the measure and the rhetoric of black money, why would anyone find a cashless economy desirable?

It’s natural for someone with my political sympathies to address the above question as a matter of social justice. I am not going to do so. Instead, it’s much more revealing to understand the appeal of the cashless economy by reading the reports of its strongest proponents. Here’s a clue:

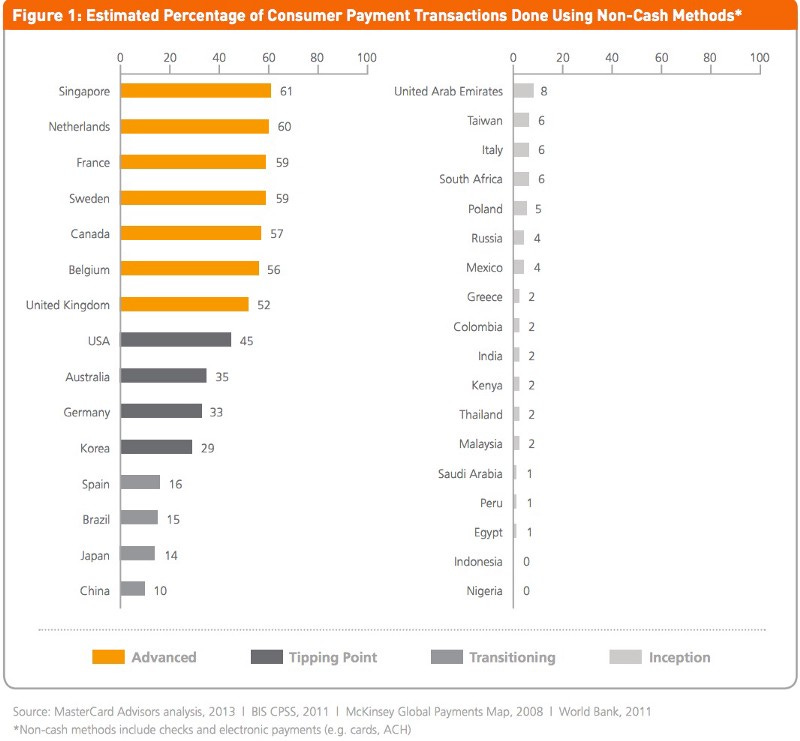

Figure 2: From MasterCard’s “Measuring Progress Toward a Cashless Society” report

The cashless crusader should be very happy with figure two — assuming correlations imply some form of causation. The left hand column is dominated by the “clean” countries of the earth while the right hand column is a list of the “dirty” countries. It’s possible there’s a sincere belief about cashless transactions helping India shift from the right hand column to the left hand one. Such beliefs are part of a well trodden analogy: just as India leapfrogged to mobile phone use without going through a period of widespread landline use, we are attempting a jump to a corruption free cashless digital economy. Then again, whether it’s corruption free or not, it will be a more financialized economy.

Is that what we want? Do we have a system to support this new infrastructure? Would it be a good thing even if we did?

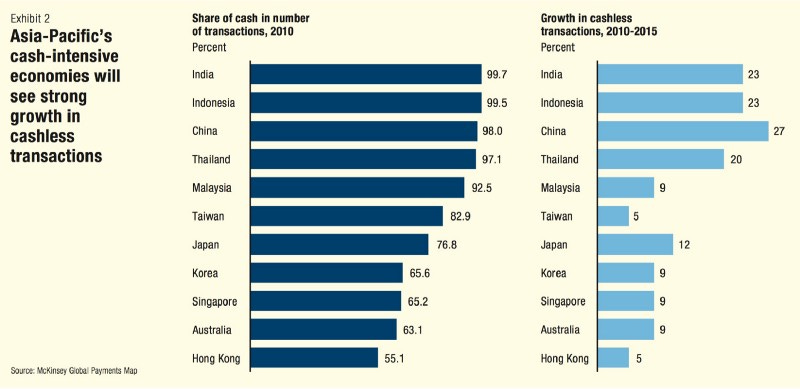

I am not going to answer that question. Instead, I am going to point to a comparison that we all love to make: India vs China. Our superpower obsessed decision making class will surely notice that China is doing a lot better than India in the cashless race. Here’s a graphic from McKinsey :

Figure 3: “Insights from McKinsey’s Asia-Pacific Payments Map”

Cashless payments in India and China are both growing, but China is growing faster than India. Mastercard makes it a point to say that:

Among transitioning countries, China has by far the strongest trajectory. China’s growth can be attributed to rapid urbanization and a strong government push to replace cash with electronic payments.

In a short note, the CEO of the Bangkok Bank says:

The Chinese government is also pushing China towards a cashless society. As in Thailand the authorities are keen to encourage the use of non-cash payments as it will reduce the cost of printing, circulating and handling banknotes, and help in the battle against tax evasion and corruption, as well as other illegal activities.

Doesn’t that sound familiar? China’s economic moves have been a step or two ahead of India. Xi Jinping inherited a financializing economy when he came to power in 2012. I don’t think it’s a coincidence that China’s push toward a cashless society comes at a time when:

President Xi Jinping has promised to crack down on corruption. Or, depending on what you think:

President Xi Jinping has used an anti-corruption drive to target his political opponents and concentrate power in his hands.

Narendra Modi, like Xi Jinping, is a charismatic leader heading a cadre based party that supposedly doesn’t like personality politics. Should we be surprised that he’s going the same route as the Chinese leader?

I don’t think so

I am not saying that the Indian prime minister is copying the Chinese president. They are similar politicians with similar interests responding to similar conditions. They will hit upon a similar solution to their political needs. Whether in India or in China, cash and its digital replacements are intimately tied to power.

In the second part of this article, I will talk about the new forms of centralized state power that comes from a cashless society.